10 Reasons to Get a Home Generator

Power outages can be a major inconvenience. They can also create problems for you, your family and your home as you shift into "emergency mode" to prevent your food from spoiling, to safely navigate your home in the dark, or simply to keep the heat on. Investing in a home generator can help make being without power more bearable — and can even fuel some fun when not being used for an emergency.

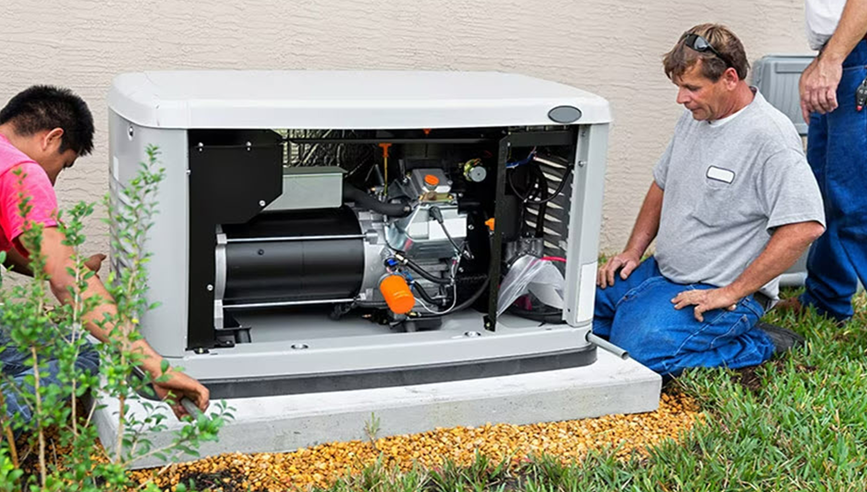

Home generators come in a variety of types and sizes, from portable versions to "standby" and inverter units. Portable generators typically run-on gasoline and need to be operated at a safe distance from any structure. Standby generators start automatically when the power goes out and are run on propane or natural gas. Inverter generators have a more complex engine than the other types and are much quieter than their conventional counterparts. Regardless of which type of generator you choose, you will need to follow the manufacturer recommendations for safe operation of the unit.

It’s helpful to research this useful home device before you urgently need it, so here are 10 reasons to consider purchasing a home generator of your own.

1. We can’t control the weather.

Most power outages are weather-related. As the number and severity of extreme weather events rises, so does the likelihood of a blackout lasting 24 hours or more.

2. You have well water.

Without electricity, your well pump and filtration systems will quickly lose the ability to provide fresh, safe water for drinking, bathing, heating and more, to your house.

3. You have a sump pump.

If you rely on a sump pump to keep your basement or crawlspace dry — including all the possessions you keep in those areas — losing power means you may also lose protection against water damage in those areas.

4. You work from home.

If you run a business or work out of your home, you know every minute counts. Going without power for even an hour can be a major inconvenience — if not a major risk — to you, your clients and customers.

5. Food spoils quickly.

According to the Government of Canada, perishable food items should be thrown out once your refrigerator has been at room temperature for as little as two hours.1

6. You live in a high-risk or severe climate area.

Some provinces are more vulnerable to weather-related outages. Others have such severe temperature extremes that power to control air conditioning and heating systems can be essential for comfort and safety. If you live in one of these areas, your risk to the potentially devastating effects of a power outage increases significantly.

7. Your property is vacant for extended periods of time.

If you are a "snowbird," frequent traveler or own a seasonal home, having a generator can protect your property from outage-related emergencies — whether you’re in or out of town.

8. Someone in your home relies on an electrically powered medical device.

If you or a loved one requires the assistance of a home medical device that runs on electricity, a power outage can be deadly. A generator can help keep those devices running, but you also will want to check with a healthcare professional for suggestions on how to weather power outages with your particular medical device.

9. You have a hybrid or electric car.

Make a portable generator go the extra mile! When not using it for your basic emergency power needs, keep it in your car to stay charged no matter where the road takes you.

10. Generators aren’t just for emergencies.

Portable generators can be put to use at work or play in, around and away from your home, too:

- Camping.

- Portable power tools.

- Outdoor parties & events.

Whether it’s due to storms, falling trees or some other challenge, power outages can bring an assortment of problems for homeowners. A home generator can become one of your go-to remedies for those unexpected situations. Checking out the options before you lose electrical power is one smart way to beat the crowds who’ll be racing to scoop up a home generator, for that "next time" outage scenario.

Learn more about Travelers homeowners insurance products, or contact your local independent broker to ensure that you have the coverage you need.